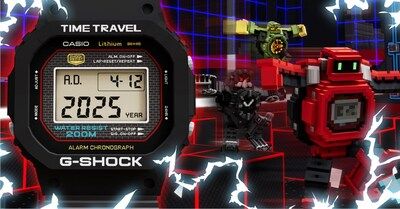

Casio to Deliver Metaverse-Based Experiences in Collaboration Between G-SHOCK and The Sandbox

Offering Limited-Edition NFTs and Game Content Expressing the Brand’s Worldview

TOKYO, Aug. 5, 2025 /PRNewswire/ — Casio Computer Co., Ltd. announced today a collaboration with the Web3*[1] metaverse gaming platform The Sandbox as part of the VIRTUAL G-SHOCK project involving the G-SHOCK brand of shock-resistant watches. In an ongoing rollout beginning September 3th, game content offering experiences of the G-SHOCK worldview will be made available, along with limited-edition non-fungible tokens (NFTs) and avatars.

*[1] Web3 (Web 3.0) refers to the next generation of the Internet, a decentralized network realized with blockchain technology. |

Now, as part of the project, G-SHOCK City will be made available on the Web3 metaverse gaming platform The Sandbox, and limited-edition NFTs will be sold. Visitors to G-SHOCK City will have opportunities to learn about G-SHOCK history in an adventure-game format and enjoy survival races based on a shock-resistance testing theme.

Overview of the “G-SHOCK Droid Collection” Avatar Sale

A robot-style official avatar for The Sandbox, inspired by the iconic G-SHOCK design, will be released. Based on G-SHOCK four iconic styles — DW-5600, DW-6900, GA-110, and GA-2100 — as well as the bold and oversized GA-V01, each avatar features a unique design that makes the most of the special properties of NFTs.

Schedule

- Allowlist*[2] registration start date: 2:00pm, August 5 (Tues), 2025 (UTC)

- Date of sales launch: 2:00pm, September 3 (Wed), 2025 (UTC)

*[2] Register of pre-approved users with preferential rights to purchase NFTs |

Sales prices

*[3] SAND is the native utility token of The Sandbox, used for participating in the platform’s ecosystem, purchasing items, and accessing experiences. |

Photo – https://www.007stockchat.com/wp-content/uploads/2025/08/image_5009366_22010921.jpg

Photo – https://www.007stockchat.com/wp-content/uploads/2025/08/1.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/casio-to-deliver-metaverse-based-experiences-in-collaboration-between-g-shock-and-the-sandbox-302521553.html

View original content:https://www.prnewswire.co.uk/news-releases/casio-to-deliver-metaverse-based-experiences-in-collaboration-between-g-shock-and-the-sandbox-302521553.html

Featured Image: depositphotos @ Primakov