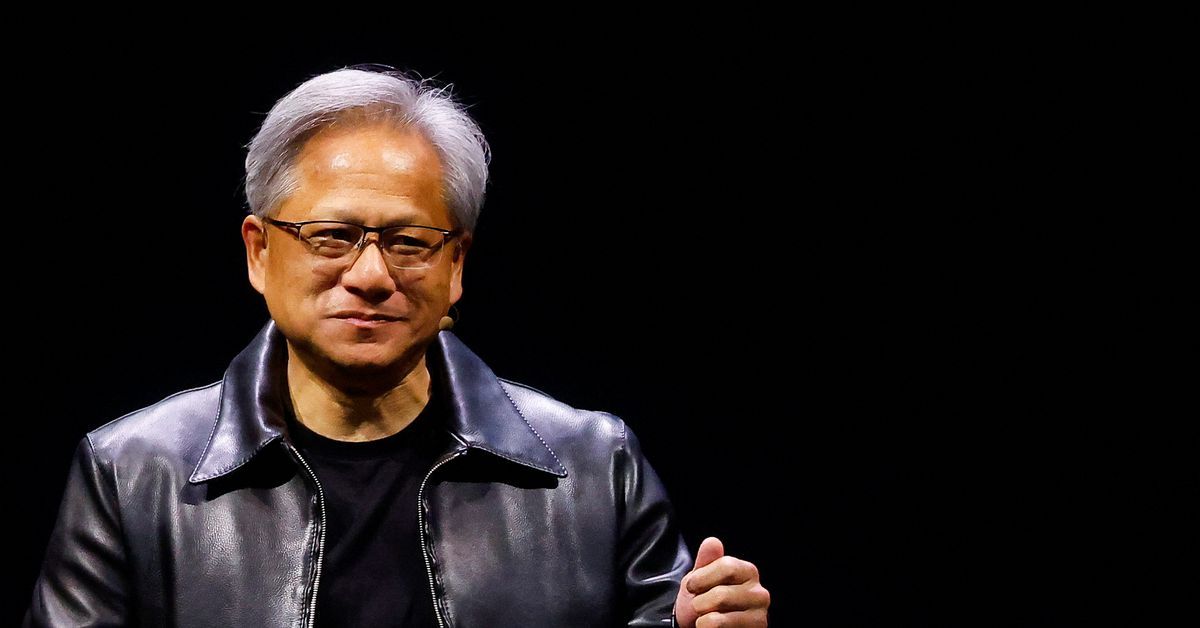

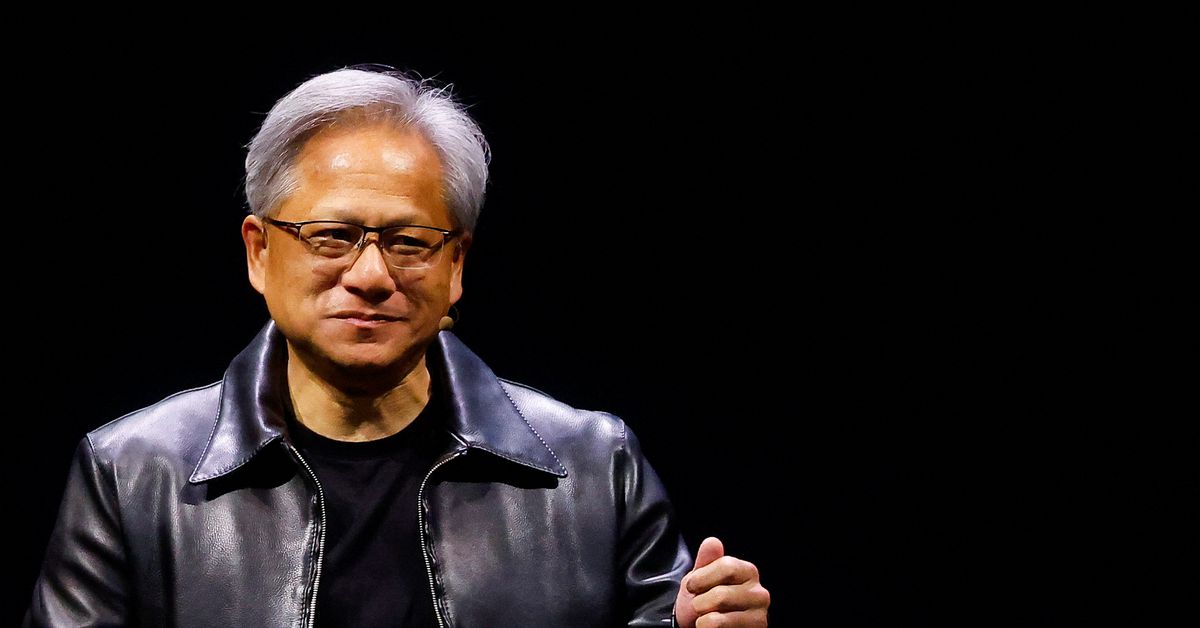

NVDA – AI means everyone can now be a programmer, Nvidia chief says

TAIPEI, May 29 (Reuters) – Artificial intelligence means everyone can now be a computer programmer as all they need to do is speak to the computer, Nvidia Corp (NVDA.O) CEO Jensen Huang said on Monday, hailing the end of the “digital divide”.

Nvidia has surged to become the world’s most valuable listed semiconductor company as a major supplier of chips and computing systems for artificial intelligence.

The company last week forecast second-quarter revenue more than 50% above Wall Street estimates and said it was boosting supply to meet surging demand for its artificial-intelligence chips, which are used to power ChatGPT and many similar services.

Speaking to thousands of people at the Computex forum in Taipei, Huang, who was born in southern Taiwan before his family emigrated to the United States when he was a child, said AI was leading a computing revolution.

“There’s no question we’re in a new computing era,” he said in a speech, occasionally dropping in words of Mandarin or Taiwanese to the delight of the crowd.

“Every single computing era you could do different things that weren’t possible before, and artificial intelligence certainly qualifies,” Huang added.

“The programming barrier is incredibly low. We have closed the digital divide. Everyone is a programmer now – you just have to say something to the computer,” he said.

“The rate of progress, because it’s so easy to use, is the reason why it’s growing so fast. This is going to touch literally every single industry.”

Nvidia’s chips have helped companies such as Microsoft Corp (MSFT.O) add human-like chat features to search engines such as Bing.

Huang demonstrated what AI could do, including getting a programme to write a short pop song praising Nvidia with only a few words of instruction.

He unveiled several new applications, including a partnership with the world’s largest advertising group WPP (WPP.L) for generative AI-enabled content for digital advertising.

Nvidia has strained to meet demand for its AI chips, with Tesla Inc TSLA.O CEO Elon Musk, who is reportedly building out an artificial-intelligence startup, last week telling an interviewer that the graphics processing units (GPUs) are “considerably harder to get than drugs”.

Reporting by Ben Blanchard; editing by Jason Neely

Our Standards: The Thomson Reuters Trust Principles.